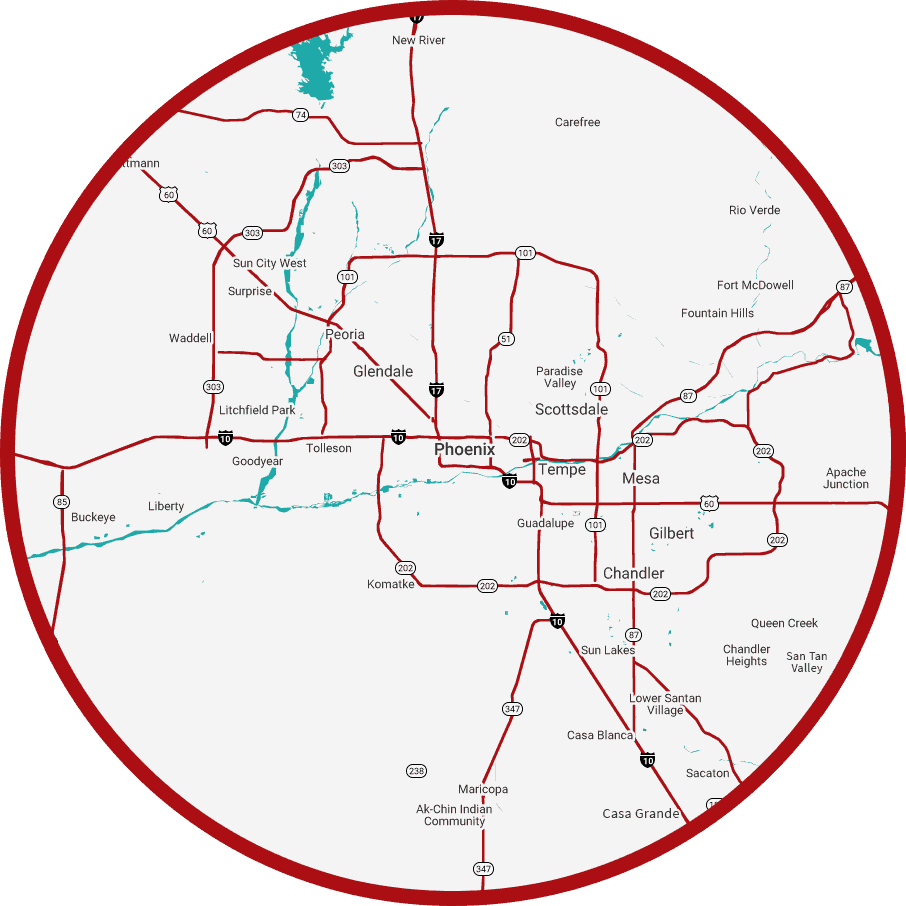

As a resident of Mesa, Arizona, water damage may be a serious concern for you as a homeowner. It can be a daunting experience to deal with the aftermath of water damage, but knowing how to file a claim with your homeowner’s insurance can make the process much easier. Here at Rocky Mountain Restoration, we’ve compiled a guide to help you navigate the process of filing a water damage claim with your insurance provider.

Contact Your Insurance Company

The first step in filing a water damage claim is to contact your insurance company as soon as possible. It is essential to notify them quickly so that they can begin processing your claim and start the evaluation process. You should have evidence of the water damage, such as photographs, readily available to help them accurately assess the damage.

When you contact your insurance provider, they will likely send an adjuster to inspect the damage, taking measurements and photographs of the affected area. During the evaluation, the adjuster may ask questions about the cause and origin of the damage, who was at fault, and any documentation you may possess. To ensure accurate representation of what happened, it’s crucial to keep detailed records of your interactions with adjusters, which can also aid when filing claims later as additional documentation or agreeing on different adjusters may be requested from you.

Before the insurance inspection, it’s wise to relocate any belongings in the affected area. This will protect against further damage while decreasing the amount of money needed for repairs. If you hire a contractor for temporary repairs, save all receipts as they will form part of your total settlement agreement.

Document the Damage

Documentation is critical when filing a water damage claim with your insurance company. It’s essential to photograph or videotape any water damage and the affected items to provide evidence to support your claim. Additionally, providing your insurer with an updated home inventory should help them accurately value your belongings before the flooding occurred.

When dealing with leaky appliances such as water heaters or washing machines, keeping records detailing when and how long the device has been leaking will give your insurance provider an accurate picture of whether or not your problem constitutes a covered loss.

As soon as the damage occurs, it’s advisable to have a plumber inspect the area and take photos or video footage of its severity. Drying-up areas where there may be water or mold accumulation could help avoid further destruction to floors, walls, and baseboards.

Once you have documented the damage, you can file your insurance claim. This can be done online, over the phone, or through paper forms. Contact your insurance agent or company before filing your claim to ensure you have all the documentation needed to help ensure you get enough money to rebuild your home after flooding has occurred.

Early filing of your claim increases the speed with which the insurer can assess and pay for repairs. Following these simple steps will make the process simpler for both you and your insurer.

Schedule an Inspection

Cleaning services insurance claims can be among the costliest types, as major repairs and restoration work often follow an incident. Thus, making an accurate and fair claim is indeed possible with proper planning and execution.

When filing a water damage claim, you should schedule an inspection with your homeowner’s insurance provider. An adjuster will come and inspect your property, potentially requesting photos and measurements to assess how extensive the damage is.

Once the adjuster has assessed the damage, they will provide you with a written estimate of how much it will cost to repair the property. They may ask questions regarding its cause and timing to accurately calculate repair costs.

If any temporary repairs have been completed on your property, keep receipts for these works so you can submit them as invoices to your insurance provider and seek reimbursement from them.

Inspectors often rely on infrared cameras to spot hidden water damage. The camera enables them to spot leaks not visible to the naked eye, potentially saving thousands in repairs if caught early enough. As another way of avoiding hidden water damage, buying a house with a strong foundation and drainage system is also beneficial in protecting against future issues following repair of damage. These features may prevent further issues from emerging after any repair work has been completed.

Make a Claim

Water damage claims are among the most frequently filed with homeowner insurance policies, accounting for roughly one-fourth of total claims filed, according to the Insurance Information Institute. Therefore, it is crucial that you file your water damage claim with your homeowner’s insurance as quickly as possible, otherwise, they could find other grounds to deny your claim.

Homeowners insurance is an excellent way to safeguard against perils like fire, storms, and theft. Should any such event arise, the best thing you can do to file a claim is contact your insurer immediately. This allows them to send an adjuster out quickly who can assess damage and determine repairs required before sending out a check for payment of said work.

If the water damage resulted from you not taking action to address issues with your plumbing, for instance, your insurance company might deny your claim. Neglecting water issues in your house could lead to mold growth, which is both costly and detrimental to health. Immediate remediation must occur to stop further structural damage as well as respiratory conditions such as asthma or bronchitis developing due to mold spores spread by these organisms.

Mold can increase your insurance rates. Many insurance companies utilize a database called Comprehensive Loss Underwriting Exchange (CLUE) to calculate how much they should charge you for their policies. This is why it’s essential to file a water damage claim as soon as possible.

When filing a claim, take notes detailing everything that needs repairing to demonstrate the extent and cause of the damage. This will enable you to successfully establish what occurred during a claim investigation. Once you have an exhaustive list of items needing repairs, gather any receipts possible as evidence of damages. A public adjuster could also assess and negotiate with insurers on your behalf.

In general, the claims process will go smoothly, and you should be reimbursed for any costs of damage sustained to your property. However, you should continue checking with your insurer regularly throughout this process to ensure everything is handled in an expedient manner.

Additionally, you can also seek assistance from relevant agencies such as National Flood Insurance Program (NFIP) to learn more about water damage restoration and insurance claims.

At Rocky Mountain Restoration, we understand how devastating water damage can be to your property and peace of mind. As a water damage restoration company located in Mesa, Arizona, we are experienced in dealing with water damage claims and can help guide you through the process. We are available 24/7 to provide emergency water damage restoration services, and our team of experts can assist with insurance claims to ensure that you receive fair compensation for your losses.

In conclusion, water damage claims can be challenging to file, but with the right guidance and documentation, you can successfully file a claim with your homeowner’s insurance provider. Remember to act fast, document the damage, schedule an inspection, and make a claim. At Rocky Mountain Restoration, we are here to help you through every step of the process and provide the necessary water damage restoration services to get your property back to its pre-damage condition.